Pacific Prime for Beginners

Insurance coverage additionally aids cover costs connected with obligation (lawful responsibility) for damage or injury caused to a 3rd event. Insurance is an agreement (policy) in which an insurance firm indemnifies another versus losses from certain contingencies or perils.

Investopedia/ Daniel Fishel Several insurance coverage kinds are offered, and essentially any private or business can find an insurance company going to guarantee themfor a rate. Usual individual insurance plan kinds are car, wellness, property owners, and life insurance policy. A lot of people in the USA contend least one of these types of insurance, and auto insurance is required by state legislation.

6 Simple Techniques For Pacific Prime

Locating the price that is ideal for you needs some research. Optimums may be established per duration (e.g., yearly or policy term), per loss or injury, or over the life of the policy, additionally understood as the lifetime optimum.

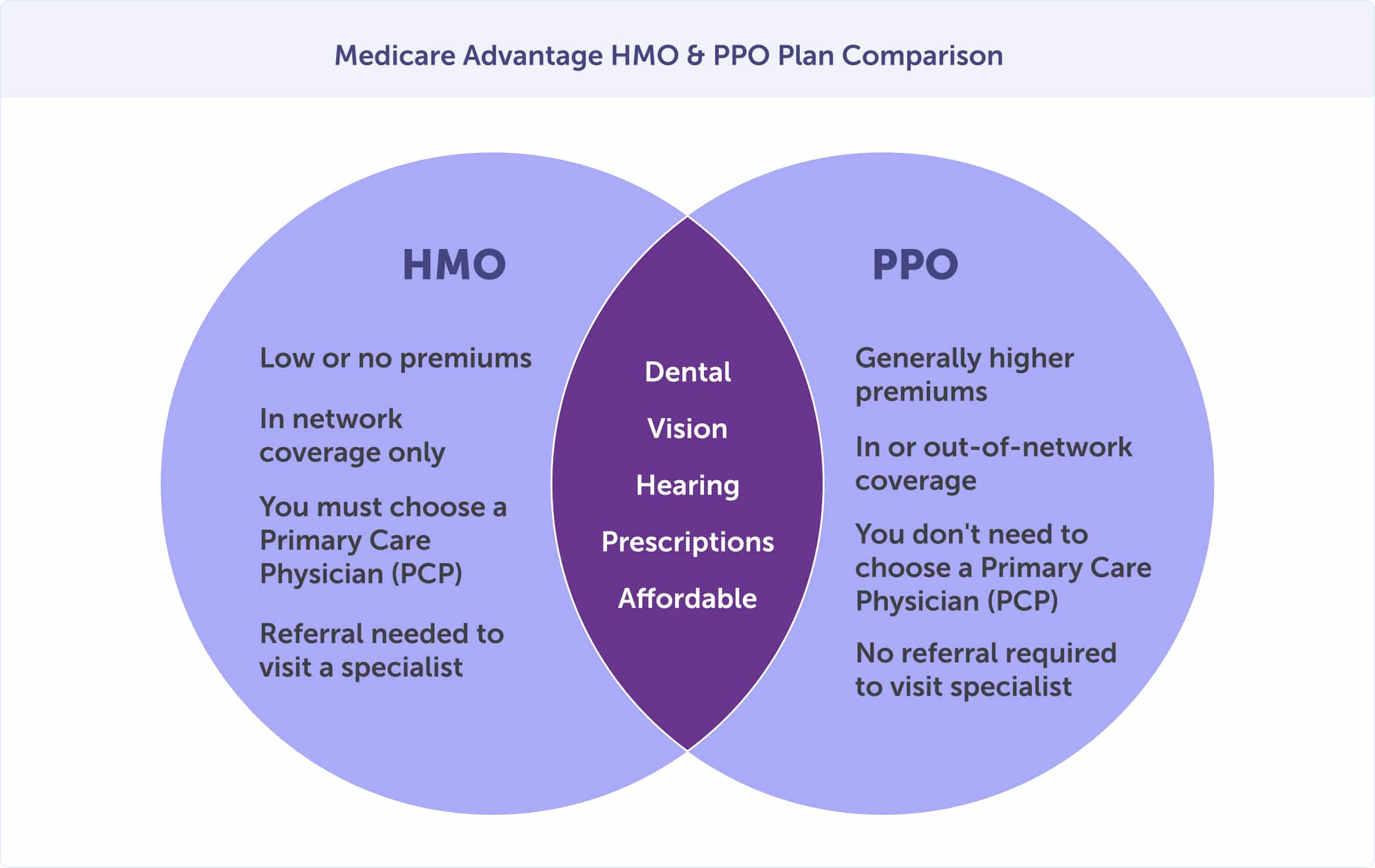

There are several various types of insurance policy. Health insurance helps covers regular and emergency medical treatment expenses, typically with the choice to include vision and dental solutions separately.

Nonetheless, lots of precautionary services might be covered for free prior to these are met. Medical insurance may be bought from an insurer, an insurance policy representative, the federal Wellness Insurance coverage Industry, supplied by an employer, or federal Medicare and Medicaid coverage. The federal government no more calls for Americans to have medical insurance, however in some states, such as California, you may pay a tax obligation penalty if you don't have insurance policy.

The Single Strategy To Use For Pacific Prime

Rather than paying of pocket for vehicle mishaps and damages, individuals pay yearly costs to an auto insurance provider. The business then pays all or a lot of the protected prices connected with a car crash or various other automobile damage. If you have actually a leased vehicle or borrowed money to purchase a car, your lender or renting dealer will likely require you to bring car insurance.

A life insurance policy policy guarantees that the insurance provider pays a sum of money to your recipients (such as a spouse or youngsters) if you pass away. In exchange, you pay premiums during your life time. There are 2 major sorts of life insurance. Term life insurance policy covers you for a details period, such as 10 to 20 years.

Insurance coverage is a method to handle your monetary risks. When you buy insurance, you purchase security against unanticipated financial losses. The insurer pays you or someone you select if something negative happens. If you have no insurance policy and an accident takes place, you might be in charge of all related expenses.

An Unbiased View of Pacific Prime

Although there are many insurance coverage plan kinds, several of the most typical are life, wellness, house owners, and auto. The best sort of insurance for you will depend upon your objectives and economic circumstance.

Have you ever had a minute while looking at your insurance coverage policy or buying for insurance when you've assumed, "What is insurance? Insurance can be a strange and puzzling thing. Exactly how does insurance coverage job?

No one wants something negative to happen to them. Yet experiencing a loss without insurance coverage can place you in a challenging monetary situation. Insurance coverage is an essential monetary device. It can help you live life with fewer fears understanding you'll get economic support official source after a catastrophe or crash, helping you recover quicker.

The Ultimate Guide To Pacific Prime

And in some cases, like automobile insurance coverage and employees' settlement, you may be called for by regulation to have insurance policy in order to protect others - international health insurance. Learn more about ourInsurance choices Insurance is basically a gigantic rainy day fund shared by many individuals (called policyholders) and taken care of by an insurance policy carrier. The insurance provider makes use of money collected (called premium) from its insurance policy holders and various other investments to spend for its procedures and to accomplish its guarantee to policyholders when they sue